January 5, 2018

• 1 Minute Read

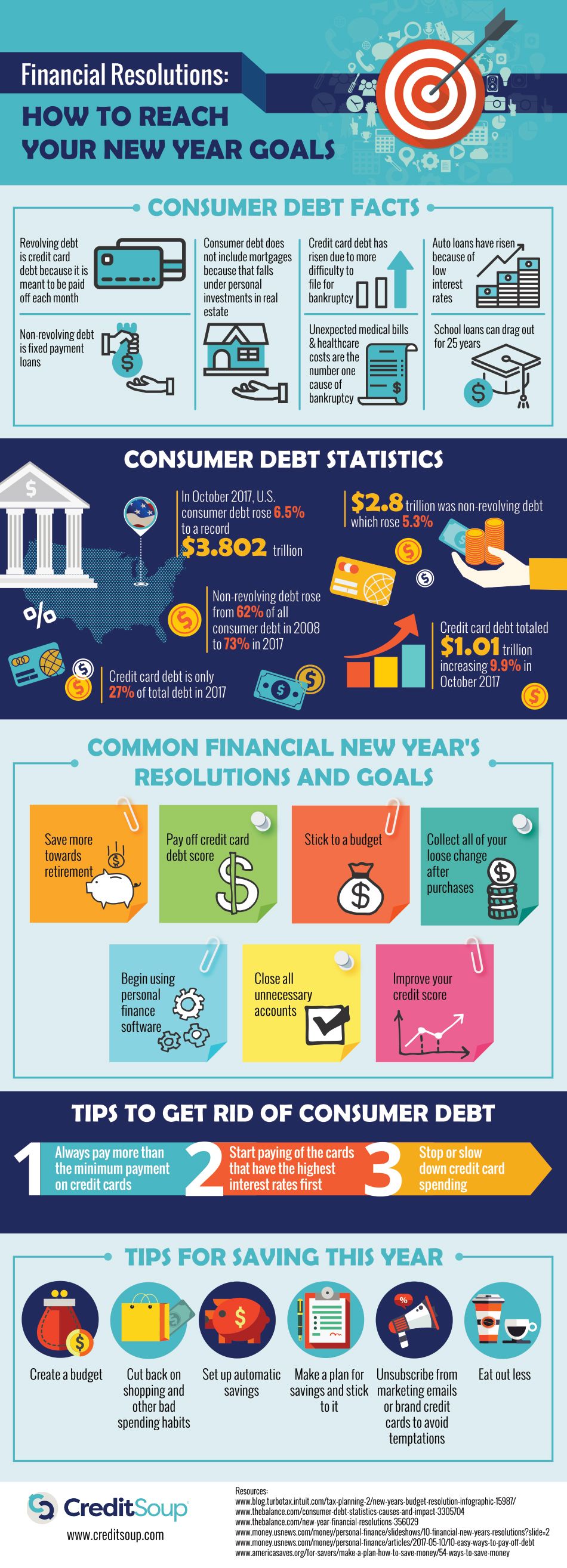

By the end of the year, you probably have some regrets when it comes to how you’ve handled your finances. With mortgages, credit cards, and student loan debt, there are tons of reasons why your nest egg might not be as big as you’d like and your credit score is in the red. First of all, know that you’re not alone – in 2017, consumer debt rose 6.5%, bringing the total to nearly $4 trillion! But even though consumer debt is a continually growing issue, it doesn’t have to be your problem too.

In order to conquer debt and regain financial control in the New Year, you’ll need to familiarize yourself with some key terms and strategies. We’ve put together an infographic detailing the facts you need to know about consumer debt, tips for ridding yourself of debt, and a handy list of goals to strive for in the coming year.

Editorial Disclaimer: Information in these articles is brought to you by CreditSoup. Banks, issuers, and credit card companies mentioned in the articles do not endorse or guarantee, and are not responsible for, the contents of the articles. The information is accurate to the best of our knowledge when posted; however, all credit card information is presented without warranty. Please check the issuer’s website for the most current information.